Bank of america home equity loan calculator

Banking credit card automobile loans mortgage and home. Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Rates may vary due to a change in the Prime Rate a credit limit below 100000 a.

. This would mean that if you borrowed 50000 you might expect to pay 1000 to. A home equity loan or home equity line of credit HELOC allow you to borrow against your ownership stake in your home. 1234 Main Street Charlotte NC 28255.

Apr 21 2022 The bank put its home equity line of credit HELOC program on pause. 85 of that is 170000. Ad Compare The Best Home Equity Lenders.

Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements. Now that you have your estimated home price check out different loan options with our Mortgage Calculator. Wells Fargo Checking Account Bonus Bank Of America.

The Loan term is the period of time during which a loan must be repaid. Get Lowest Rates Save Money. For more information about Bank of Americas HELOC visit the banks website or call 800-779-3894 Monday through Friday 8 am.

The Bank of America offers large HELOCs at. Rates may vary due to a change in the Prime Rate a credit limit below 100000. What Every Homeowner Needs To Know.

Through Bank of America you can generally borrow up to 85 of the value of your home minus the amount you still owe. Ad Compare The Best Home Equity Lenders. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

As of July 28 2022 the variable rate for Home Equity Lines of Credit ranged from 570 APR to 1010 APR. Use Our Rate Payment Loan Amount and Refi Calculators to See What You Think. Ad Give us a call to find out more.

Under Texas law the combined loan-to-value CLTV cannot exceed 80 of your homes value. Enter your address Ex. For example if your current balance is 100000 and your homes market value is.

Click on the submit home equity documents link on the Loan Details page or Click on the Submit Home Equity. For example a 30. A home equity loan of 50000 for 15 years at a simple interest rate of.

If a HELOC resembles a credit card a home equity loan is more like the original home mortgage. Your homes equity is the difference between the appraised value of your home and your current mortgage balance. Through Bank of America you can generally borrow up to 85 of the.

This is our estimate of your. Ad Give us a call to find out more. Value of home Mortgage balance Homes Equity.

Home equity loans typically have a closing cost ranging between 2 and 5 of the amount borrowed. Get Lowest Rates Save Money. 33 Make the most.

The line of credit is based on a percentage of the value of your home. Year Dollars Home Equity Line of Credit Payoff Schedule Interest Paid. Central Daylight Time and assume borrower has excellent credit including a credit score.

To calculate your homes equity divide your current mortgage balance by your homes market value. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Related links Bank America HomeContact UsLocationsHelpSchedule appointmentMortgage Mortgage Mortgage LoansToday Mortgage RatesMortgage CalculatorClosing Costs.

Estimate your homes value. Bank of America offers HELOCs but does not offer home equity loans. Mortgage rates valid as of 12 Sep 2022 0248 pm.

To upload your home equity documents directly from your computer. Year Dollars Home Equity. However they offer a fixed rate option for a HELOC at each draw.

Home Equity Calculator Index. As of July 28 2022 the variable rate for Home Equity Lines of Credit ranged from 570 APR to 1010 APR. Year Dollars Home Equity.

Get the Cash You Need w the Help of Discover. An eligibility checklist home value estimator and rate calculator. HELOC For example say your homes appraised value is 200000.

Home affordability estimate and monthly payment are based on a 30. ET or Saturday from 8 am. The interest rates are.

A home equity loan calculator is a good way to start exploring price options for tapping the equity in your home. Enjoy the predictability of fixed payments when you convert some or all of the balance on your variable-rate home equity line of credit HELOC to a Fixed-Rate Loan Option. See how much your home is worth.

Ad Loan Options from 35-300k.

Home Equity Loans Home Loans U S Bank

Mortgage Loan To Get Debt To Income Ratio Line Of Credit Home Equity

Home Equity Line Of Credit Heloc Rocket Mortgage

Bank Of America Downgrades Lennar And Toll Brothers Warns Homebuilders Face A Valuation Crunch In 2022 Toll Brothers Building A House Bank Of America

What Every Homeowner Needs To Know About Home Equity Home Equity Equity Money Management Advice

Pin On Naca Success Stories

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Bank Of America Heloc Review September 2022 Is It A Good Idea Finder

Pin On Naca Event Locations

Home Equity Line Of Credit Heloc Rocket Mortgage

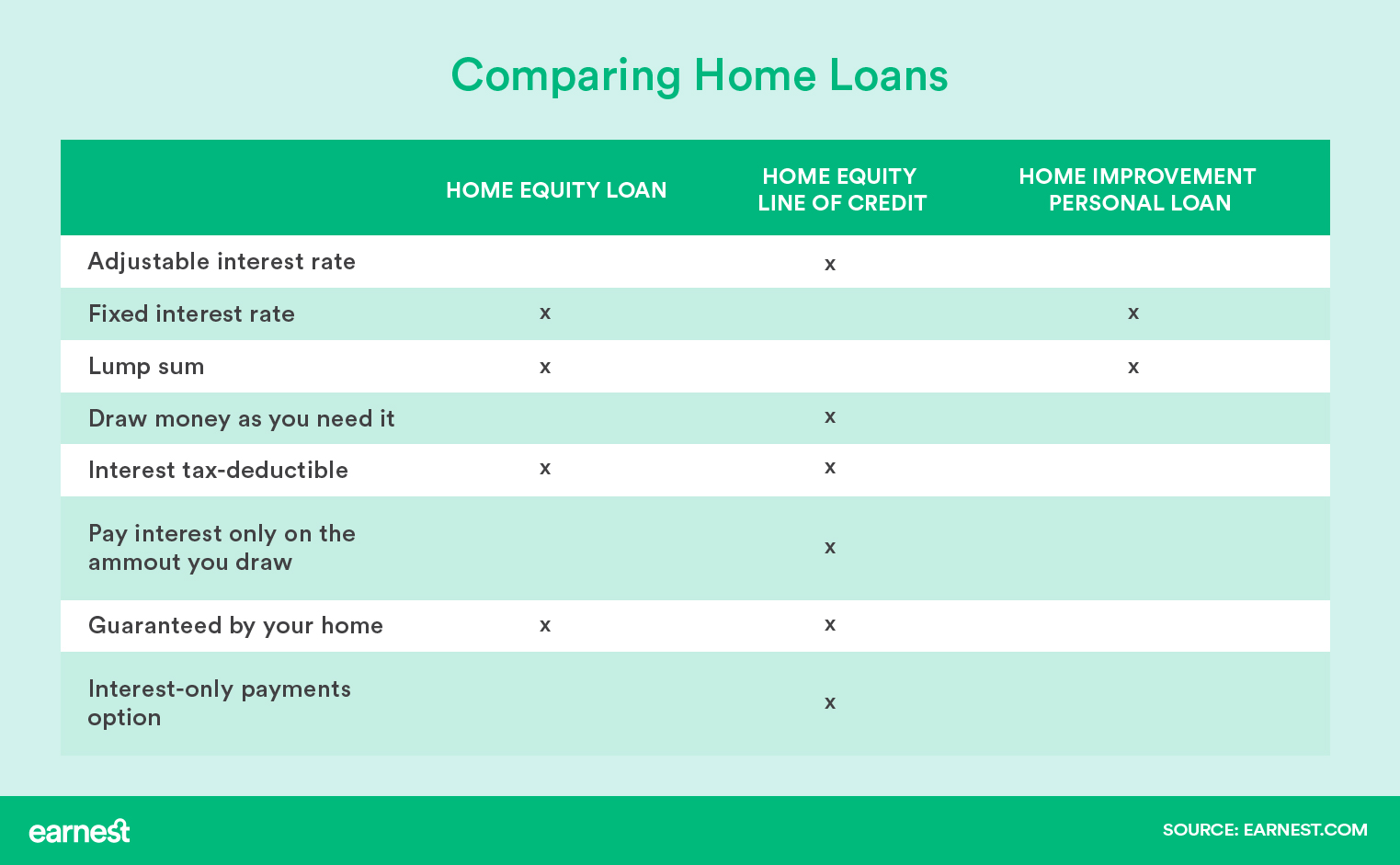

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Real Estate Blog Home Selling Tips Home Buying Tips New Home Buyer

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

Pin On Banking Human

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Should I Work With A Morgage Broker Or Big Bank Mortgage Brokers Mortgage Mortgage Loans

Bank Of America Mortgage Lender Review Nextadvisor With Time